The in-city housing market in our Emerald City has a split personality. Buy or rent, the message is the same – it’s going to cost more and more to live here. This fact is reigniting the debate between renting and homeownership and developers are listening.

Downtown Seattle is a very robust rental market, which has welcomed more than 12,500 new construction units since 2011. Despite this massive increase in supply, economist Brian O’Connor says rents have still grown by more than 40-percent over this term due to an imbalance with supply and demand. According to Zumper, Seattle is now in the top ten most expensive rental markets in the nation with a median price of $1,800 per month (half are more, half are less) for one-bedroom apartments. Average rents of newer apartment towers downtown can demand $3.50 to $4.25 per square foot, per month. So a 600 sq. ft. one bedroom could easily cost a renter $2,100 to more than $2,500 per month. That kind of monthly payment could service a healthy mortgage. Recently, Zillow stated that 22-percent of Seattle’s renters can afford to buy. They have the incomes and credit scores to own, so why don’t they?

“Convenience – most of the recent apartment demand is from transplants fulfilling job openings in the Seattle area – especially within the tech industry,” said Dean Jones, President and CEO of Realogics Sotheby’s International Realty (RSIR). “A new recruit will more likely rent first to see how their job works out before laying down roots and making large financial commitments. Generally speaking it doesn’t pencil to own unless the resident lives in the home for more than a few years within a rising market.”

That said, Jones is quick to mention that the residential surge on in-city housing began five years ago so he’s not surprised that many renters are now seeking to own.

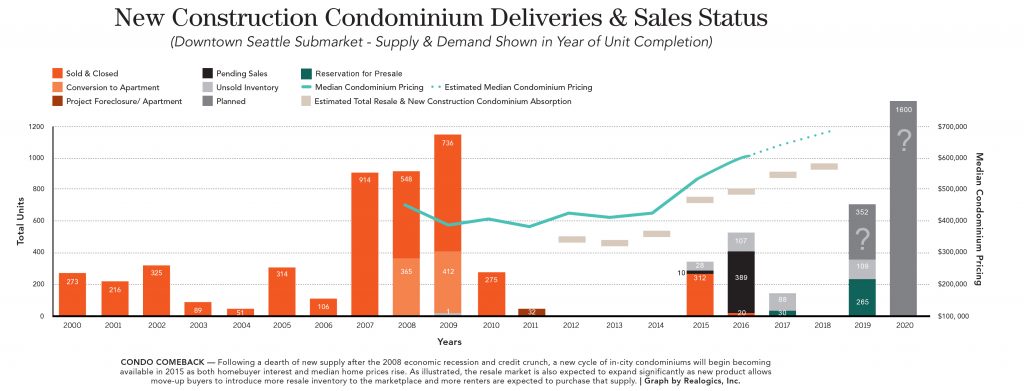

Meanwhile, developers delivered only 866 new condominiums for sale over the past five years compared to 12,500 apartments; does that mean the demand for homeownership is now 6.5-percent of the population? Jones says the condominium market overcorrected because developers preferred to build apartments. They have been just as profitable with less risk and liability, benefitting from high rents and low capitalization rents (below 4-percent). Essentially, large investment funds have been paying as much for an apartment building as they would be worth as individual condominiums. Why? Because they think that rents will grow even more and the demand for housing in Seattle is seemingly insatiable. The Washington State Department of Licensing reports that in September 2016 alone, nearly 7,000 requests for driver’s licenses were processed, led by Californians relocating to the area. The majority of these new residents will settle in the urban markets of Seattle and Bellevue. Most will rent for now, but perhaps not for long.

“These new apartment towers are effectively incubating future homebuyers,” adds Jones. “After a few years of digesting rent increases and having no tax benefits, homeownership begins to make more sense. We’re seeing many of those renters becoming buyers – some immediately targeting resale opportunities and others planning ahead exploring condominium presales.”

Rising demand to buy has led to the return of condominiums in the pipeline, finally. Still no new, for-sale inventory had delivered in downtown Seattle since 2010, until 2015 when Insignia – a 698-unit twin tower condominium built in Belltown – began closing units that started preselling in 2013. In total, 350 units in the south tower were delivered in 2015 and 348 units in the north tower began occupying in 2016. This project was followed by LUMA, the 168-unit condominium tower on First Hill that begun closing during the summer of 2016. Approximately 40 units remain available for sale at Insignia and LUMA, as well as a few resale units that are being offered at higher prices. It’s important to note that most of the closings are presales that have occurred in the years past and may reflect lower prices than what could be achieved today.

Looking ahead, Gridiron in Pioneer Square will deliver 107 units in 2017. This historic brick building in the Stadium District is being converted into new construction condominiums with approximately 25 homes sold or reserved to date. Given the lack of additional groundbreakings and protracted construction schedules required by high-rise construction, it’s unlikely any new condominiums will enter the market in 2018. Additional supply isn’t expected until 2019 and 2020, and not before consumers experience significant increases in home prices.

For the first three quarters of 2016, the median home prices of condominiums in downtown Seattle rose by 18-percent to $670,050 – the highest benchmark pricing to date. Total sales volumes also increased by 18-percent to 766 closed homes year-over-year. While it’s true these statistics are responding to a plethora of new construction units, the resale market is also rising quickly. When removing all new construction closings, the median prices of resales (built before 2015) rose 14-percent to $515,000 during the same period. The lack of inventory, however, can be seen in lighter transaction volume as resales represented by 388 closings for a more modest 5-percent increase compared with 2015, accordingly to analysis of the NWMLS. Currently, there are only 77 resale units listed for sale in downtown Seattle with an average asking price of $759,000.

The price points where these sales are occurring is also significant. Year-to-date in 2016 (as of September 30), the total volume of home sales below $500,000 decreased by 25-percent, while the number of closings from $500,000 to $1 million increased by 36-percent, year-over-year. Moreover, the number of closings priced above $1 million increased by 83-percent during this period compared with the prior year.

“The market is faced with two realities – firstly, it’s difficult to deliver new housing options priced below $500,000 anywhere in Seattle and secondly, consumers are quickly absorbing existing inventory,” adds Jones. “For some perspective, there are currently only 25 homes available in downtown Seattle with price points below $600,000.”

Jones says this price point is particularly in demand because buyers can own for as little as 5-percent down payment and conforming mortgages and low interest rates means total monthly payments are similar to prevailing rents.

Above: The demand for more attainable price points in downtown Seattle has diminished the supply of homes priced below $500,000 while developers struggle to deliver new homes in this attractive price range.

Above & Below: Moving on up – the median home prices for downtown condominiums have continued to increase year-over-year (YTD Q3-2016) while the average days on market have steadily decreased.

In a demonstration of the pent up demand, 21 out of 25 resale condominiums sold in September 2016 priced below $600,000 closed at or above the asking price, many with multiple offers. Likewise, NEXUS, a new 383-unit condominium tower proposed at 1200 Howell Street in downtown Seattle, advertised priority presale reservations with homes starting in the low $300,000s would begin on June 4th, 2016. The sales team arrived to a line outside the Preview Center that stretched around the block. Some eager homebuyers even spent the night in order to secure preferred selection. Within a few days, several hundred reservations were collected. Currently, 80-percent of the 383 units have a first position reservation with many also having second position reservations. Clients of RSIR Broker Dehlan Gwo hold a number of these first and second position reservations.

Above: The NEXUS condominium tower is already 80-percent reserved for priority presales, with clients of Dehlan Gwo holding a handful of these reservations. Homes ranging in value from the low $300,000s to more than $3 million – occupancy 2019.

“There’s a clear sense that the market is getting tighter and more expensive so reservations and presales make perfect sense,” said Cannon. “Buyers appreciate the security of a preferred purchase opportunity without the fear of multiple offers, escalating prices, or missing out altogether. In retrospect, a few hours in a line may have saved future homebuyers months or years waiting on another opportunity. In today’s market, time is not on your side.”

Reservations for presales offered a preliminary floor plan and price range and required a refundable deposit of $5,000. Reservation holders are required to be prequalified to purchase and the agreements are non-transferrable. Cannon says each reservation will convert to a Purchase and Sale Agreement this winter once the Sales Center is complete and the project breaks ground for 2019 occupancy.

The demand to live in downtown Seattle isn’t limited to first time buyers or entry-level prices. Brokers at RSIR report increased sales with all products and price points. Median home prices in surrounding single-family neighborhoods are establishing new benchmark levels exceeding their prior peak in 2007 before the Great Recession cooled the market. Many empty nesters simply stayed put, awaiting the convergence of high resale values with exciting new condominiums to choose from before deciding to downsize.

A review of the central Seattle submarket that includes Capitol Hill, First Hill, Madison Park, Madison Valley, Washington Park, Denny Blaine and Madrona (NWMLS #390) shows that single-family homes in the area are experiencing almost precisely the same trending as downtown Seattle condominiums. For the first three quarters of 2016, median home prices hit $789,500, reflecting an increase of 16-percent year-over-year while the number of closings were tighter at 702 sales, a decrease of 3-percent. Like downtown, however, the number of home sales priced below $500,000 fell more significantly by 55-percent dropping to just 54 homes in this more affordable price point. Currently, only 31 single-family homes are available priced below $500,000 representing just 21-percent of the active supply. The story is virtually identical in the in-city submarket of Queen Anne and Magnolia (NWMLS #700) where median home prices also increased 16.8-percent to $895,000 year-over-year and sale volumes slowed by 5.2-percent to 491 homes. Available homes priced below $500,000 are even slimmer with just 17 current opportunities.

Above & Below: Record prices are being paid for homes in neighborhoods surrounding the downtown Seattle submarket including this Broadmoor manse (above) that closed for $6,150,000 this summer and this pending sale on a $3,400,000 floating home on Eastlake (below).

“Prospective buyers of luxury condominiums in downtown Seattle can now successfully sell their current residence, whether that’s a single-family home or another condominium,” suggests Jones. “Now that liquidity has returned to the market, buyers can explore the alternatives without selling short of their expectations. That’s a healthy prognosis for our in-city condo market.”

Jones points to a few pending sales that demonstrate condo confidence. On September 20th after just two days on the market, RSIR broker Scott Wasner accepted a contract on a 5,170 sq. ft. condominium estate at Escala – the very unit and building was inspiration for the famous 50 Shades of Grey book and movie. Priced at $8,800,000, the home is among the most valuable condominiums in downtown Seattle and the closing will help establish a new product segment for trophy properties. Wasner also represented a buyer for the last unit at Four Seasons Private Residences, which was sold and closed at full price for $7,155,000 or $1,594 per sq. ft. after 2087 days on market – that’s nearly six years. A new development entity notably acquired all the unsold new construction units at Four Seasons Private Residences after the Great Recession. They patiently and effectively waited for the market to rise, which is precisely what happened.

“I believe we are witnessing the start of new condominium cycle,” adds Jones.

Above & Below: Market setting price points are being paid for luxury condominiums in downtown Seattle including the 5,170 sq. ft. residence at Escala (above) that is pending on it’s $8,800,000 asking price and a recent closing on a $7,155,000 home at The Four Seasons Private Residences (below).