The Sky Retreat at Insignia. Photo courtesy of Dehlan Gwo/John G. Wilbanks.

IS DOWNTOWN SEATTLE SOLD OUT?

Lack of New Construction Inventory Trims Overall Absorption, Only 42 Resale Units Available

With an urban center of more than 70,000 residents, it’s remarkable that only 42 resale homes are listed for sale on the NWMLS with a median asking price of $1,175,000. Just 3 resale listings are available at prices below $500,000 and only 15 are priced below $1,000,000. Now consider that there are 46 pending resales, which means the rate of sales is eclipsing the supply of new listings. July is just a continuation of a trend discovered earlier when the first half of 2017 revealed diminishing affordability and an acceleration of luxury sales in downtown Seattle.

Anemic supply is also to blame for lighter sales absorption in July 2017. In total, just 44 homes closed last month at a median home price of $667,603. At first glance, this is significantly lower sales volumes than a year earlier when 166 new and resale condos closed. It’s true that downtown Seattle posted a slightly higher median home price of $681,000 last July, however, the major difference is that just one new construction condo sold last (according the NWMLS) whereas a year earlier there were 109 such closings at the newly constructed Insignia in Belltown, including 21 priced above $1,000,000. Thus when looking at resale properties alone, the total sales in July were still off by 33-percent to 43 closings compared with the year prior, but median home prices of these resales actually increased by 27-percent to $660,206.

"Those 'new construction' units in Insignia of 2015 and 2016 are now fetching resale prices well above what the original owners paid for them," says Dehlan Gwo, who recently listed and sold a unit in the Insignia South tower that received much attention and closed for over-asking price.

“The market is not slowing down at all, and we are witnessing a crisis brewing with inventory as downtown is effectively sold out,” said Dean Jones, President and CEO of Realogics Sotheby’s International Realty. “The lack of new construction supply and corresponding closings will persist and that will put upward pressure on the resale housing stock. We expect median home prices to continue climbing and there’s not much in the pipeline in terms of new construction either.”

Jones says buyers are often confused by 70 tower cranes in the skyline and assume there’s ample condo supply being built. The reality is that only two of those new projects are condominiums with the substantial majority being apartments for rent, office buildings and hotels. Furthermore, approximately 80-percent of that new supply being built for sale is already presold. He notes a few new projects are on the horizon but with construction costs rising by 8-percent per year and a prevailing supply and demand imbalance, buyers will be waiting until 2020 or beyond for new inventory and prices will be substantially higher.

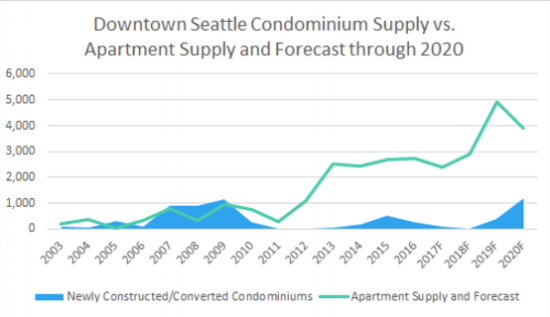

The graph above illustrates the overwhelming preference of developers to build new apartments for rent instead of condominiums for sale for the current decade – just 6-percent of the new supply is offered for purchase.

Interestingly, that single “new construction” condo that sold last month isn’t truly new. It was a resale at Insignia, a new condominium built in 2016 but labeled as new. That said, unit #809 at 583 Battery Street is a typical 1 bedroom, 1 bathroom home of 931-square feet on the 8th floor, and just sold for $825,000 after multiple offers escalated the closing 6-percent above the original listing price of $780,000. Even more notable, this same home closed with its first owner just a year earlier for $546,300, according to NWMLS and was evidently rented for a year and then resold last month for a 51-percent increase above its presale value. This evidences how quickly the downtown condo scene is evolving.

“These competitive market dynamics highlight a key advantage of presales at new developments like NEXUS,” said Michael Cannon, Sales Director for the 41-story high-rise condominium being built at the corner of Howell Street and Minor Avenue. “Our presale buyers can lock into a new home today without multiple offers or price escalation and they don’t need to close until mid-2019. This provides plenty of time to plan ahead and sell an existing property (if needed) into an appreciating market. There can also be significant increases in value from presale to resale, especially if median home prices in the Seattle-area keep rising at more than 1-percent per month.”

The graphs above and below depict the composition of new construction and resale inventory listed and sold in July on the NWMLS and highlight the mounting affordability crisis.

NEXUS recently added nine new listings to help bring more inventory to the market as follows:

- Unit 1108 – GG – 2B/2B – $999,950

- Unit 3102 – III – 2B/2B – $1,019,950

- Unit 2905 – DD – 2B/2B – $1,125,000

- Unit 3001 – AA – 2B/2B – $1,170,000

- Unit 2411 – G – 2B/2B – $1,269,950

- Unit 3011 – X – 2B/2B – $1,270,000

- Unit 2701 – V – 2B+D/2B – $1,599,950

- Unit 2704 – T – 2B+D/2B – $1,750,000

- Unit 3600 – U – 2B+D/2B – $1,899,950

“Since debuting in March, we’re more than 80-percent sold and beginning to sell through some popular floor plans,” adds Cannon. “So far our developer has held to our introductory prices but I would anticipate some price increases in the weeks and months ahead.”

Multiple offers on several homes have occurred at NEXUS but Cannon was successful in realigning competitive buyers to different homes avoiding price escalation and generating more sales. He admits, however that this sort of shuffling will become more difficult as inventory runs dry and an increasing number of buyers target a dwindling number of units.

Above: A SKANSKA worker snaps a cell phone picture from atop the crane tower at NEXUS – the only high-rise condominium currently being built in downtown Seattle.